How to write a check with no cents? If you’ve ever found yourself facing the perplexing task of writing a check with no cents, fear not – you’re not alone in this financial problem. In this comprehensive guide, we’ll navigate the intricacies of writing a check without dealing with those pesky cents, ensuring your financial transactions are smooth sailing. Let’s dive right in.

Table of Contents

1. The Basics: How to Start Writing a Check with No Cents

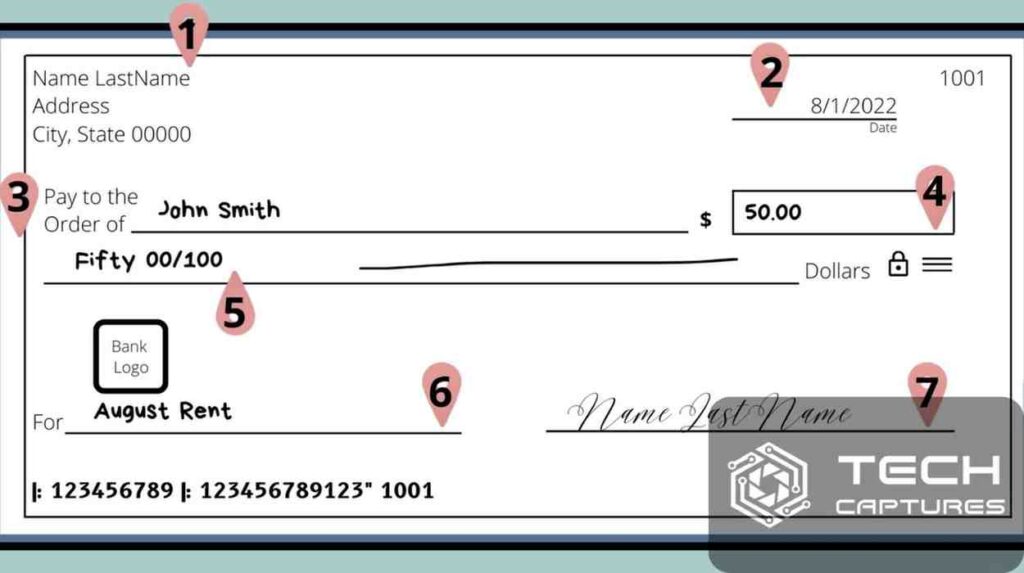

Let’s begin at the beginning. How to write a check with no cents starts with the basics. Grab your trusty checkbook and find a quiet spot – we’re about to embark on a journey through the essential components of a check.

Transitioning from dollars to cents, ensure the numerical amount is placed in the box on the right side of the check. For instance, if you’re writing a check for $150, write “150.00” in this box. Leave the cents field empty to signify that you’re dealing with whole dollars.

2. Spelling It Out: The Amount in Words

Now that we’ve tackled the numerical aspect, it’s time to put pen to paper and spell out the amount in words. This serves as a double-check to ensure there’s no ambiguity in your transaction. If you’re writing a check for $150 with no cents, write “One Hundred Fifty and 00/100” on the line designated for the amount in words. It’s a fail-safe way to communicate the exact amount you intend to pay or transfer.

3. Sign on the Dotted Line: Why Your Signature Matters

Your signature is the John Hancock that seals the deal, transforming a mere piece of paper into a legally binding financial document. In the context of how to write a check with no cents, your signature holds even more significance. It’s your stamp of approval, signaling to the bank that you authorize the specified amount.

When writing checks with no cents, the absence of a numerical value in the cents field underscores the importance of your signature. Ensure your signature is consistent with the one your bank has on file, avoiding any discrepancies that could lead to potential issues.

4. Navigating Common Pitfalls: Tips for Error-Free Check Writing

As we embark on this journey of financial finesse, let’s address some common pitfalls that can trip up even the most seasoned checkwriters. When learning how to write a check with no cents, it’s crucial to be aware of potential stumbling blocks.

- Double-Check the Payee: Before you put pen to check, ensure the payee line accurately reflects the intended recipient. A misstep here could lead to unintended financial consequences.

- Mind Your Postdating: If you’re postdating a check, make sure the date is clearly written and aligns with your intentions. Postdating can be a useful strategy, but clarity is key.

- Crossing T’s and Dotting I’s Precision matters. Take a moment to review your check for any spelling errors or discrepancies between the numerical and written amounts. A small oversight can lead to big headaches.

5. Security Measures: Protecting Your Check-Writing Prowess

In the realm of finance, security is paramount. When considering how to write a check with no cents, implementing security measures is not only smart but essential.

- Use Gel Pens or Microtip Pens: These pens create indelible ink, making it more challenging for alterations or fraud. Safeguard your financial transactions by choosing the right writing instrument.

- Store Checks Securely: Treat your checkbook like the treasure trove it is. Store it in a secure place, preferably in a locked drawer or safe, minimizing the risk of unauthorized access.

6. The Digital Twist: Writing Checks in the Digital Age

In an era dominated by digital transactions, the art of checkwriting may seem quaint. However, it’s a skill that remains relevant, even in the age of online banking. When pondering how to write a check with no cents, consider the digital twist.

- Electronic Check Writing: Some banks offer electronic check-writing features, allowing you to generate and send digital checks. While the format may differ, the fundamental principles of check writing remain intact.

- Security in the Digital Realm: Just as with traditional checks, digital checks require diligence. Implement multi-factor authentication and regularly update passwords to fortify the security of your digital financial endeavors.

7. Beyond the Basics: Advanced Check-Writing Techniques

Now that we’ve established a solid foundation, let’s elevate our check-writing game. Beyond the basics of how to write a check with no cents, advanced techniques can add finesse to your financial transactions.

- Memo Line Mastery: The memo line isn’t just for decoration. Use it strategically to jot down essential details about the transaction. Whether it’s a payment reference or an account number, leveraging the memo line can enhance clarity.

- Abbreviation Etiquette: Space on a check is limited, so mastering abbreviations can be a game-changer. Learn the commonly accepted abbreviations for states, ensuring a concise yet accurate representation of your payee’s location.

FAQs

Can I Write a Check with No Cents if the Amount is a Round Number?

Absolutely. If your transaction involves whole dollars, leave the cents field blank. This streamlined approach is not only acceptable but also common.

What if I Make an Error on a Check?

Fear not. Mistakes happen. If you make an error, void the check and start afresh. Never attempt to correct mistakes with alterations, as this may raise red flags.

Is Online Check Ordering Safe?

Online check ordering is generally safe if you use reputable vendors. Ensure the website is secure (look for “https” in the URL), and consider reviews from other users for added assurance.