Real estate tokenization has moved from an intriguing experiment to a transformative force in global property markets — but its future now depends on regulation more than technology. As this innovative approach unlocks liquidity, broadens participation, and lowers entry barriers, governments and regulators around the world are racing to provide legal clarity and investor protection. The Tokenizer.Estate Blog has become a trusted source for professionals navigating this shifting landscape, with its detailed Real Estate Tokenization Regulation: A Country-by-Country Guide offering a comprehensive look at how different jurisdictions are setting the rules for tokenized property.

Table of Contents

Why Regulation Is Now at the Core of Tokenized Real Estate

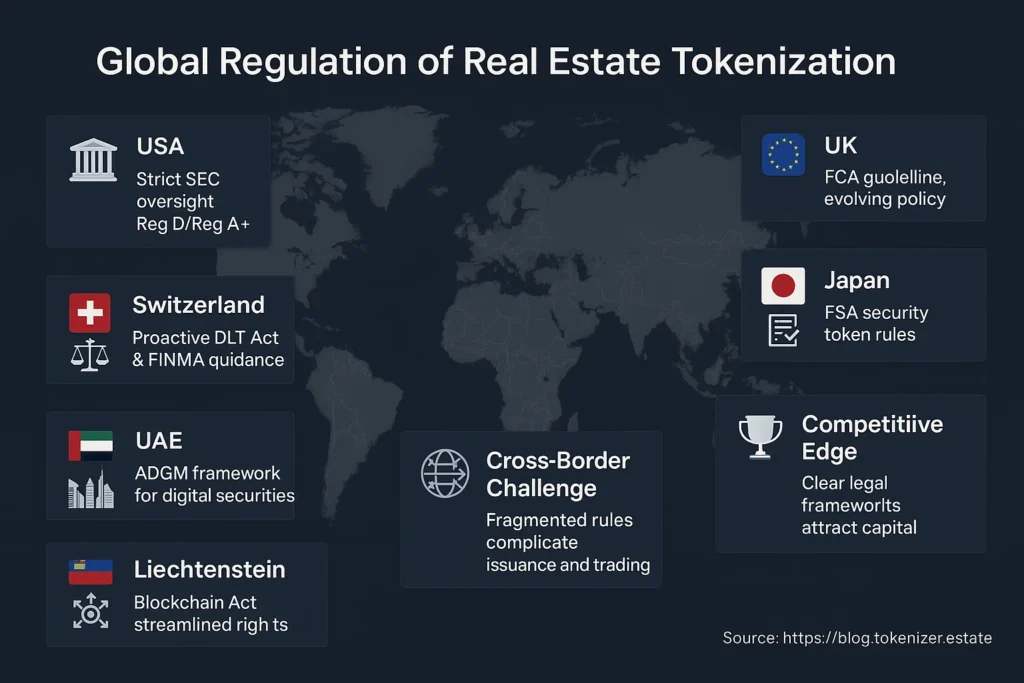

While blockchain technology has proven its capacity to fractionalize ownership and enhance transparency, a robust regulatory environment is what makes these benefits viable in the real world. Without clear rules, investors face legal uncertainty, issuers risk non-compliance, and platforms struggle to build trust at scale. For tokenization to become mainstream, national frameworks must balance innovation with investor safeguards — and the stakes are high. Countries that create supportive, clear, and practical laws stand to attract significant capital and become hubs for next-generation property finance.

United States: Stringent but Structured

The United States remains one of the largest markets for tokenized real estate but also one of the most tightly regulated. The U.S. Securities and Exchange Commission (SEC) treats most real estate tokens as securities, which subjects issuers to complex compliance requirements under existing securities laws. Projects often rely on exemptions like Regulation D for private placements or Regulation A+ for limited public offerings. While this provides a clear pathway, the costs and legal workload can be prohibitive for smaller issuers. Still, the regulatory maturity offers investors a high degree of protection, which supports long-term trust in the ecosystem.

European Union: Harmonizing Through MiCA

Across the EU, the Markets in Crypto-Assets (MiCA) regulation is emerging as a central framework to harmonize how member states treat tokenized assets. MiCA aims to standardize licensing, disclosure, and consumer protection for crypto-assets — including tokenized real estate — while the pilot regime for distributed ledger technology (DLT) is designed to test new market infrastructures under regulatory supervision. This mix of pan-European coordination and sandbox-like experimentation has positioned the EU as a promising, if sometimes bureaucratic, region for tokenized property ventures.

Switzerland: A Proactive Pioneer

Switzerland continues to set the benchmark for supportive digital asset regulation. The Swiss Financial Market Supervisory Authority (FINMA) recognizes blockchain-based securities and offers clear legal pathways for token issuers under its DLT Act. This pragmatic approach, combined with Switzerland’s strong tradition of financial privacy and investor protection, has attracted numerous tokenization platforms. The country’s proactive stance makes it one of the most advanced jurisdictions for tokenized property projects, with legal certainty and a healthy pipeline of compliant offerings.

United Kingdom: Innovation in a Controlled Sandbox

Post-Brexit, the UK is positioning itself as a global fintech leader by developing flexible, innovation-friendly rules for digital assets. Through the Financial Conduct Authority (FCA) regulatory sandbox, tokenization firms can test new models under close supervision, gaining insights while minimizing legal risk. Although the UK has yet to release comprehensive tokenization-specific rules, its commitment to a balanced framework suggests a supportive future. However, the current lack of fully codified legislation can create short-term uncertainty for large-scale projects.

Singapore: Licensing Clarity and Regulatory Engagement

Singapore has earned its reputation as a crypto-friendly jurisdiction by providing clear licensing under the Payment Services Act and engaging proactively with blockchain innovators. The Monetary Authority of Singapore (MAS) has issued guidelines on digital tokens and security token offerings (STOs), giving issuers legal certainty and encouraging investor confidence. This combination of clear compliance paths and government openness has made Singapore a magnet for tokenized property platforms looking for a stable Asian base.

UAE, Japan, Liechtenstein: Smaller Players, Big Potential

Other jurisdictions are also positioning themselves as leaders in regulated tokenization. The UAE’s Abu Dhabi Global Market (ADGM) offers comprehensive frameworks for digital securities, while Japan has established detailed guidelines through its Financial Services Agency (FSA) to ensure compliance with traditional securities law. Liechtenstein’s Blockchain Act is one of the most progressive legal frameworks worldwide, explicitly recognizing tokenized rights and streamlining issuance and transfer rules. These jurisdictions illustrate how smaller markets can punch above their weight by crafting clear, innovation-friendly laws.

The Challenge of Cross-Border Harmonization

Despite national progress, the biggest obstacle to mass adoption remains the lack of international harmonization. Real estate markets are inherently local, but tokenized assets are borderless. This mismatch complicates how tokens are issued, traded, and taxed across different legal systems. As a result, platforms must navigate overlapping rules, fragmented licensing, and varying definitions of digital securities — a costly and time-consuming task that discourages smaller players and slows innovation.

Regulation as a Competitive Advantage

Legal infrastructure is fast becoming a competitive edge for countries seeking to attract tokenization platforms, investors, and new forms of property capital. Clear, balanced, and innovation-driven regulation builds trust, reduces friction, and allows the industry to grow responsibly. Conversely, jurisdictions that delay policy development risk missing out on billions in cross-border capital and technology leadership.

Staying Ahead: The Need for Regulatory Literacy

As the sector matures, legal clarity will remain the single most important driver of trust and participation in tokenized real estate. Issuers, platforms, and investors alike must stay informed and compliant, as rules evolve and new opportunities emerge. Resources like the Tokenizer.Estate Blog offer invaluable guidance for stakeholders navigating this fast-changing landscape, helping them unlock the full potential of regulated, secure, and globally accessible real estate investment.