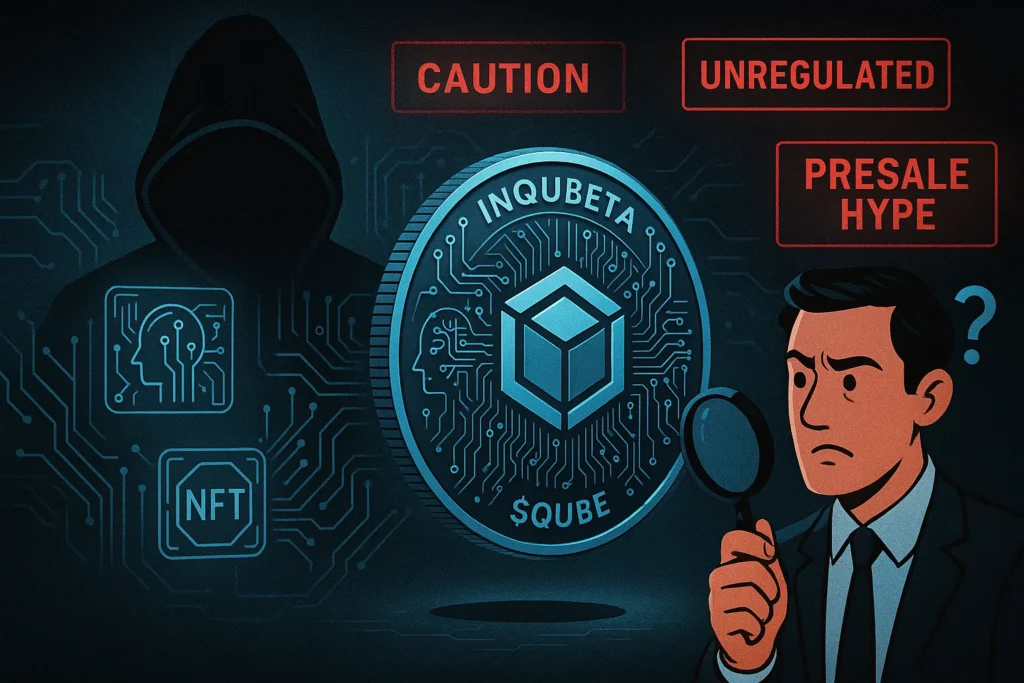

If you’ve recently come across Inqubeta price, you’re probably wondering whether it’s the next big breakthrough in AI-driven crypto or just another overhyped coin with big promises and small results. You’re not alone. With hundreds of new tokens launching monthly, finding something legitimate in the noisy world of cryptocurrency is like finding a signal in static. Let’s unpack the facts and fiction about Inqubeta, its price, its platform, and whether it truly belongs in your portfolio.

Table of Contents

What Is Inqubeta And What Does It Offer?

Inqubeta presents itself as a hybrid platform that merges AI-driven trading with NFT-based startup investments. It operates using a native token called $QUBE. According to the site, users can invest in early-stage AI startups via fractional NFTs and stake tokens for rewards. Sounds futuristic, right? But what lies beneath that promising surface?

Breaking Down the Inqubeta Price Model

Unlike conventional assets, Inqubeta’s price isn’t pegged to market demand alone. Instead, it’s influenced by a combination of presale hype, tokenomics, and speculative narratives. The project taxes buying and selling transactions burns a portion of the supply to create scarcity, and incentivizes staking to reduce circulation. These mechanics are designed to inflate Inqubeta’s price, especially in the early stages. But these mechanisms are also common red flags in pump-and-dump schemes.

The Promise Versus the Proof

Storytelling vs. Substance

Inqubeta markets itself as the gateway to investing in AI innovation through crypto. Its homepage features glowing promises about democratizing venture capital and leveraging AI for predictive trading. However, no verifiable records of startup investments, successful trades, or functioning AI tools have been made public.

Who’s Behind The Curtain?

Despite such bold promises, the platform is managed by an anonymous team. There are no named founders, no LinkedIn profiles, no physical offices, and no public roadmap beyond general marketing language. Transparency, which is a cornerstone of credible crypto projects, is starkly absent.

Problem-Solution Breakdown

The Problem With Inqubeta’s Value Proposition

The problem is clear: Crypto investors want tools that combine AI intelligence with secure investment vehicles. Inqubeta attempts to solve this by offering AI-driven market predictions and startup equity through NFTs.

But Is That The Solution?

Without a verifiable AI tool, functioning marketplace, or named startups, the solution feels like an idea still on the drawing board. Users are buying into a presale token without a functional ecosystem in place.

Inqubeta Price Compared To Other Crypto Projects

Let’s compare Inqubeta’s price and its underlying mechanics with established platforms.

Cryptohopper vs. Inqubeta

- Cryptohopper: Offers real AI trading bots with proven functionality. Charges fixed monthly fees, no tokens involved.

- Inqubeta: Offers hypothetical AI predictions. Charges indirectly through token inflation, staking traps, and presale structures.

Stoic AI vs. Inqubeta

- Stoic AI: Established AI-powered investment tool with a real trading record and human team.

- Inqubeta: No track record, no team transparency.

Verdict

Inqubeta’s price might be lower at entry compared to subscription models, but it’s not backed by real services or results. That makes its value speculative rather than performance-based.

Inqubeta Price And Investor Psychology

Price in crypto is often less about value and more about perception. Inqubeta price gains during presale are largely psychological. The platform uses scarcity tactics (like token burns) and layered incentives to keep holders from selling. These tactics are engineered to increase perceived value, rather than actual usability.

The Chronology of Inqubeta Development

- Launch: Presale begins with heavy marketing and social media campaigns.

- Middle Stage: No product launched. No marketplace activity.

- Current Status: Investors holding tokens, but there’s no real usage.

So far, Inqubeta remains in its marketing phase, with little indication that any technology or business model has been delivered.

A Persuasive Take On The Risk

Imagine investing in a new tech startup where you don’t know the founders, there’s no working prototype, and the only returns come from reselling your shares to new investors. Sounds risky? That’s essentially what investing in Inqubeta at this stage means. The price may rise, but it’s not due to business performance—it’s driven by speculative hope.

Case Study Insights From Similar Projects

Remember Bitconnect? It promised insane daily returns using AI. It ended in one of the biggest collapses in crypto history. Investors initially saw price surges, just like what the Inqubeta price is showing now. But without real backing, Bitconnect went to zero overnight. The patterns are disturbingly similar.

A Listicle Guide To Evaluate Inqubeta Price Rationally

- Is the team public and accountable? No.

- Is there a working product? Not yet.

- Do independent audits exist? Only for the token, not the platform.

- Is there regulatory clearance? No. It’s on ASIC’s investor alert list.

- Are real users vouching for results? None verified.

Inverted Pyramid Summary

Let’s get to the brass tacks: Inqubeta’s price is based more on buzz than on substance. The platform has:

- No real product

- An anonymous team

- Zero transparency

- Risky tokenomics

While early investors may see short-term spikes, the lack of fundamentals suggests long-term volatility and risk.

Q&A You Should Be Asking Before Investing

Q: Is Inqubeta regulated?

A: No, it has been flagged as unlicensed.

Q: Can I withdraw easily?

A: Many users report difficulties. Not a good sign.

Q: Who runs the company?

A: Unknown.

Q: Does it predict trades?

A: There’s no evidence of a real AI model in operation.

Final Thoughts On Inqubeta Price

The most important advice any investor can receive is simple: Don’t confuse hype for value. Inqubeta’s price may be tempted by promises of AI and innovation, but so far, those remain unfulfilled. Without real products, verifiable leadership, or any track record of success, investing in Inqubeta is more a speculative gamble than a strategic decision.